The Underperformance of Small-Cap Stocks: A Cycle Ready to Change

The Case For The ATAC US Rotation ETF (Ticker: RORO)

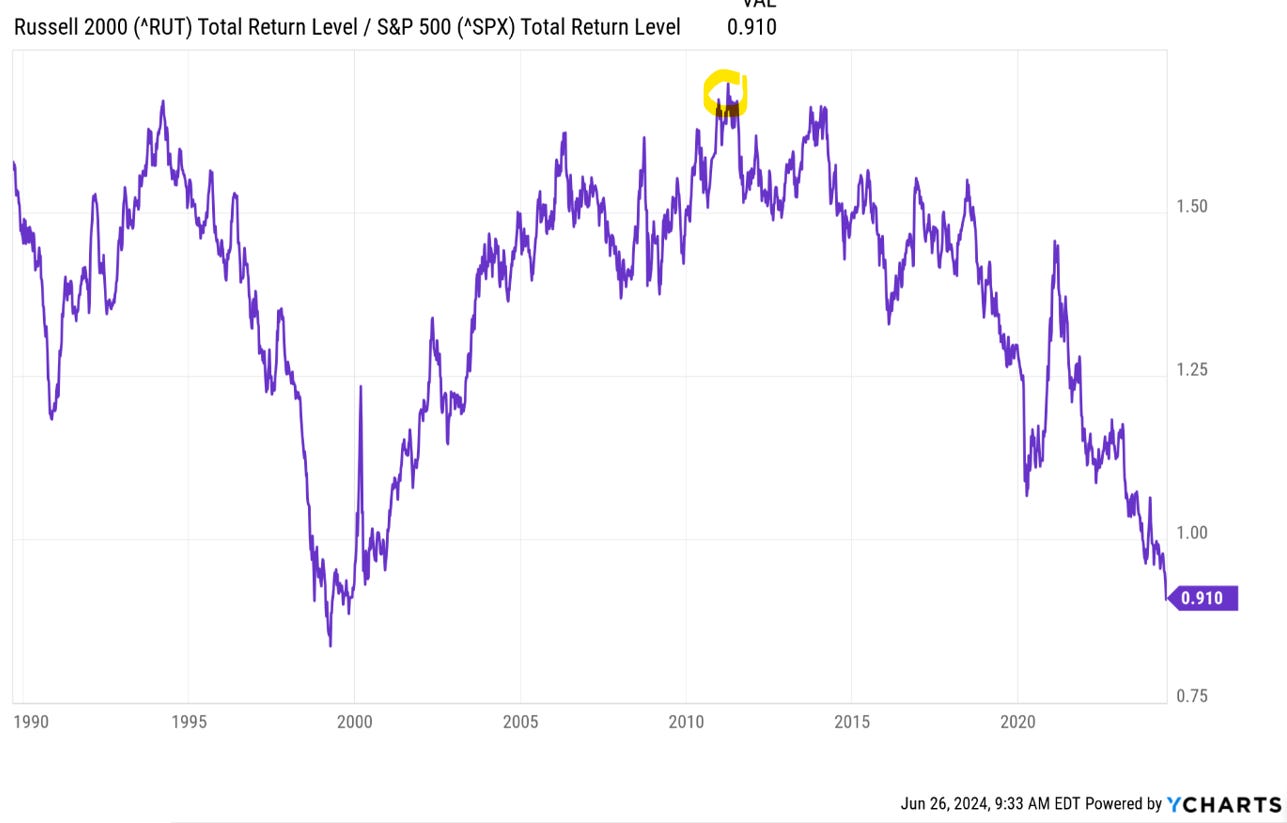

The past decade has been a challenging period for small-cap stocks, particularly those represented by the Russell 2000 index. Despite their historical outperformance over large-cap stocks, small caps have lagged significantly behind their larger counterparts, starting all the way back in 2011. The below price ratio of the Russell 2000 Index divided by the S&P 500 shows just how difficult it’s been to hold on to any relative strength.

This underperformance is largely attributed to their sensitivity to interest rates, which has created headwinds for these smaller companies. As a result, investors have flocked to large-cap tech stocks, leaving small caps in the dust. However, this is a cyclical phenomenon, and I believe that small-cap outperformance is on the horizon. This shift presents a significant opportunity for the ATAC US Rotation ETF (Ticker: RORO), which allocates to small-cap ETFs during risk-on periods.

Understanding the Underperformance

Interest Rate Sensitivity

One of the primary reasons for the underperformance of small-cap stocks is their heightened sensitivity to interest rates. Smaller companies typically rely more heavily on external financing for growth, and as interest rates rise, the cost of borrowing increases. This disproportionately impacts small-cap firms compared to their large-cap counterparts, who often have greater access to fixed-rate financing through bond issuance.

The Russell 2000, a benchmark for small-cap stocks, has seen limited gains since the beginning of 2021. Over the same period, the S&P 500 and Nasdaq-100 have surged, driven by the strong performance of mega-cap technology stocks and the AI revolution. The gap in performance between small and large caps is unusually wide, marking the worst run for small-cap stocks relative to large companies in over 20 years.

The Magnificent Seven Effect

Another factor contributing to the underperformance of small-cap stocks is the outsized impact of a handful of mega-cap tech stocks, often referred to as the "Magnificent Seven" - Amazon, Apple, Alphabet, Meta, Microsoft, Nvidia, and Tesla. These companies have driven much of the market's gains, overshadowing the performance of smaller companies. Over the past decade, the Russell 1000, which includes these mega-cap stocks, has significantly outperformed the Russell 2000. This outperformance is largely attributed to the exceptional returns of these seven companies.

*Top 10 Holdings of the ATAC US Rotation ETF (subject to change weekly)

The Cyclical Nature of Markets

Despite over a decade of underperformance, it's important to remember that markets are cyclical. Small-cap stocks have historically outperformed over the very long term, and I believe we are nearing a point where this cycle will shift in favor of small caps once again.

The Potential for Small-Cap Outperformance

Several indicators suggest that small-cap outperformance may be on the horizon. For one, small caps are currently trading at a significant discount to large caps. This valuation gap presents an attractive entry point for investors looking to capitalize on the next phase of the market cycle.

Additionally, as the Federal Reserve potentially moves towards a more dovish stance and interest rates begin to stabilize or decline, the pressure on small-cap stocks may ease. This shift could provide the necessary tailwind for small caps to start outperforming once again.

The ATAC US Rotation ETF: A Strategic Allocation

How the ATAC US Rotation ETF Works

The ATAC US Rotation ETF (RORO) is designed to tactically allocate between risk-on (equities) and risk-off (Treasuries) based on market conditions. During risk-on periods, the fund allocates to small-cap ETFs, taking advantage of the higher growth potential and volatility of small-cap stocks. Conversely, during risk-off periods, the fund shifts to more defensive long duration Treasuries to protect against market downturns driven by credit stress (something we have not seen in the last 3 years).

Why Now May Be the Time to Allocate to RORO

Given the current market conditions and the potential for a shift in the small-cap cycle, now may be an opportune time to consider allocating to the ATAC US Rotation ETF. Here are a few reasons why:

Valuation Discounts: Small-cap stocks are trading at significant discounts compared to their large-cap peers. This valuation gap provides a favorable entry point for investors looking to capitalize on the next phase of the market cycle.

Interest Rate Stabilization: As the Federal Reserve potentially moves towards a more dovish stance, the pressure on small-cap stocks may ease. This could provide the necessary tailwind for small caps to start outperforming once again.

Cyclical Outperformance: Small-cap stocks have historically outperformed over the very long term. By allocating to small-cap ETFs during risk-on periods, RORO is well-positioned to capture this potential upside.

The ATAC US Rotation ETF is designed to adapt to changing market conditions, making it a versatile tool for investors looking to navigate the complexities of the current market environment. By tactically allocating between risk-on and risk-off assets, the fund aims to provide a balanced approach to growth and risk management.

Conclusion

The underperformance of small-cap stocks in recent years has been a source of frustration for many investors. However, this is a cyclical phenomenon, and I believe that small-cap outperformance is on the horizon. As interest rates stabilize and the valuation gap between small and large caps narrows, the potential for small-cap stocks to regain their historical outperformance is compelling.

The ATAC US Rotation ETF (RORO) is strategically positioned to take advantage of this potential shift. By allocating to small-cap ETFs during risk-on periods, the fund aims to capture the growth potential of small-cap stocks while managing risk during market downturns.

Now may be an ideal time to consider an allocation to RORO, as the fund's tactical approach provides a balanced strategy for navigating the complexities of the current market environment.

If you’d like to learn more, I’m happy to discuss how the strategy works over a one-on-one call. Simply use my Calendly link to book a meeting by clicking HERE.

With Warm Regards,

Michael A. Gayed, CFA

Portfolio Manager of the ATAC Rotation Funds

Why The ATAC Rotation Funds?

Highly active strategies designed to help investors mitigate investment volatility.

Seeks to provide a differentiated return stream relative to passive strategies.

Rotates tactically offensively and defensively using historically proven leading indicators.

The Russell 2000 Index is a stock market index that tracks the performance of 2,000 small-cap US companies, serving as a key benchmark for small-cap stocks and a barometer for the US economy

The Nasdaq 100 is a stock market index comprising the 100 largest non-financial companies listed on the Nasdaq stock exchange, weighted by modified market capitalization

The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States.

Past performance is no guarantee of future results.

The Fund’s investment objectives, risks, charges, expenses and other information are described in the statutory or summary prospectus, which must be read and considered carefully before investing. You may download the statutory or summary prospectus or obtain a hard copy by calling 855-ATACFUND or visiting www.atacfunds.com. Please read the Prospectuses carefully before you invest.

Fund Risks: An investment in the Fund is subject to numerous risks including the possible loss of principal. There can be no assurance that the Fund will achieve its investment objective. Equity securities, such as common stocks, are subject to market, economic and business risks that may cause their prices to fluctuate. As with all ETFs, Fund shares may be bought and sold in the secondary market at market prices. The market price normally should approximate the Fund’s net asset value per share (NAV), but the market price sometimes may be higher or lower than the NAV. There are a limited number of financial institutions authorized to buy and sell shares directly with the Fund, and there may be a limited number of other liquidity providers in the marketplace. There is no assurance that Fund shares will trade at any volume, or at all, on any stock exchange. Low trading activity may result in shares trading at a material discount to NAV. Please see the prospectus and summary prospectus for a complete description of principal risks.

The Fund’s investments will be concentrated in an industry or group of industries to the extent the portfolio manager deems it appropriate to be so concentrated. In such event, the value of Shares may rise and fall more than the value of shares that invest in securities of companies in a broader range of industries.

Investing involves risk including the possible loss of principal.

RORO and JOJO Are distributed by Foreside Fund Services, LLC.

ATACX is distributed by Quasar Distributors, LLC.